Funding for several pandemic recovery programs continued recent trends, such as the $120 billion (47%) decrease in certain refundable tax credits (largely due to the expiration of the expanded Child Tax Credit) and $53 billion (71%) decrease in pandemic-related public health expenditures from the Public Health and Social Services Emergency Fund.īipartisan negotiations over the debt limit consumed the month of May, culminating in passage of the Fiscal Responsibility Act (FRA), signed by President Biden on June 3, 2023.Impacts reported in January, including the continued lack of spectrum auction receipts this fiscal year (counted as “offsetting receipts”), and a one-time increase in spending by the Pension Benefit Guaranty Corporation.With March’s expiration of the coronavirus public health emergency, states can reassess eligibility and disenroll those who no longer qualify, but CBO anticipates that will take several months. $31 billion (8%) increase in Medicaid, reflecting enrollment increases stemming from COVID-era eligibility policies.$38 billion (8%) increase in spending by the Department of Defense, mainly for operations, maintenance, research, and development.$48 billion (49%) increase in Department of Education programs, largely due to costs associated with the extension of the pause on student loan payments.$53 billion increase in spending by the Federal Deposit Insurance Corporation (FDIC) due to several bank failures throughout spring 2023, which it expects to recover by liquidating the banks’ assets and collecting higher premiums from other FDIC-insured institutions over several years.$112 billion (34%) increase in net interest payments on the public debt from rising interest rates and a growing debt burden.Outlays were $4.2 trillion, an increase of 11%, largely due to:*.$12 billion (18%) decrease in customs duties due to a reduction in imports.(These collections count towards federal revenue, as UI is a federal program administered by states.) $13 billion (24%) decrease in unemployment insurance (UI) receipts, as states levied higher taxes on employers during FY2022 to replenish UI trust funds that were depleted from high unemployment during the pandemic.$82 billion (99%) decrease in remittances from the Federal Reserve, as continued higher interest rates raised the Fed’s interest expenses above its income and eliminated profits across most of its banks.$99 billion (49%) increase in individual income tax refunds.Of this amount, non-withheld payments of income and payroll taxes declined by $261 billion (28%), largely reflecting a decrease in 2022 tax liabilities. $5 billion (2%) net increase in corporate income tax receipts, while individual income and payroll tax revenue declined by $299 billion (10%).Revenues were $3.0 trillion, a decrease of 11%, largely due to:.The government ran a cumulative deficit of $1.16 trillion through May ($1.22 trillion when adjusted for timing shifts, $798 billion more than during the same period last year.*).The May 2022 deficit was impacted by unique timing shifts in outlays, if not for which it would have been $131 billion instead of $66 billion, resulting in a YOY increase of $105 billion.*įiscal Year-to-Date Comparisons with FY2022 :.

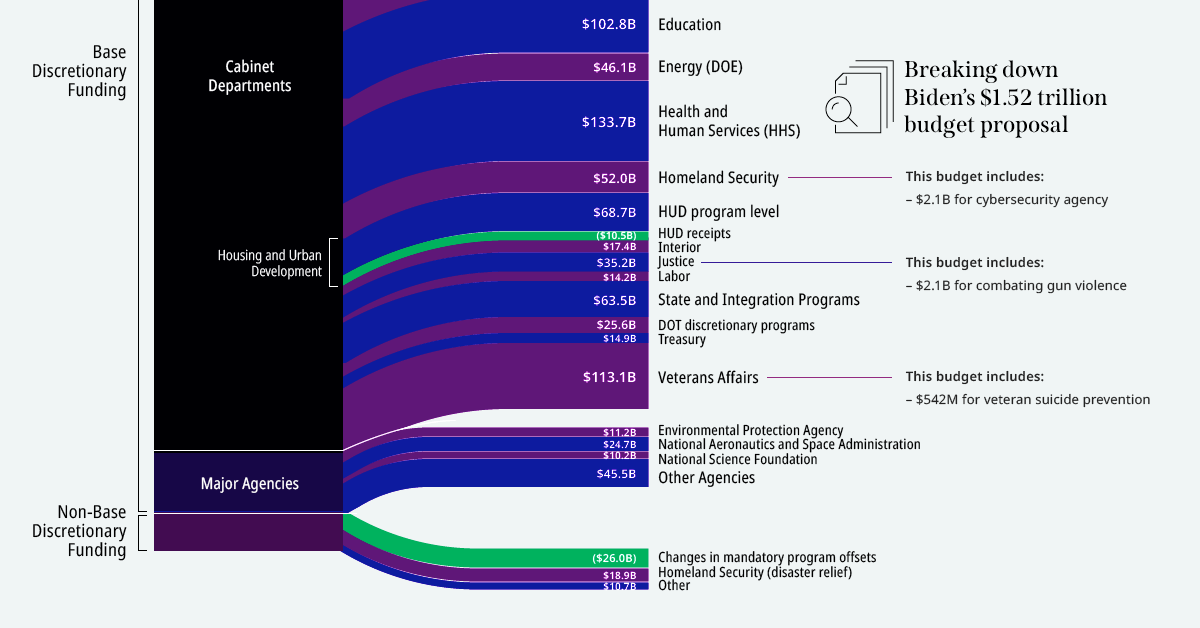

$544 billion in outlays, increased YOY by $89 billion (20%).$308 billion in revenues, decreased YOY by $81 billion (21%).$236 billion deficit, increasing year-over-year (YOY) by $170 billion.Give Search Keywords Submit Policy Areas.Source: Figure prepared by the Library of Parliament using data obtained from Department of Finance Canada, A Plan to Grow Our Economy and Make Life More Affordable, Budget 2022. Figures have been rounded or approximated to their original value and adjusted to account for negative expenses (other fiscal arrangements). Figure 1 – Revenues and Expenses of the Federal Government, 2022–2023 ($ billions)

Expenses flow out on the right side of the diagram in the form of transfers, program expenses, debt charges and actuarial losses.

Revenue flows into the diagram from the left in the form of taxes and other revenues. This diagram shows the flow of dollars where the width of each flow is based upon quantity. The outlook for budgetary revenues and expenses can be found in the 2022 Budget in tables A1.4 to A1.6.įigure 1 illustrates 2022 Budget revenues and expenses in the form of a Sankey flow diagram. It is a key component of the financial cycle. The federal budget outlines the government’s revenue estimates and expenditure priorities for the fiscal year. Home › Economics and finance › The 2022 Federal Budget at a Glanceīy loprespub on ApReading Time: 3 minutes

0 kommentar(er)

0 kommentar(er)